SEBI released a thorough analysis of India's participation in equity derivatives segment.

Equity Derivatives are based on popular indices such as NIFTY50, SENSEX and company specific like RELIANCE, GODREJ and more.

NSE, India's largest stock exchange, has a ~95% volume share in the equity derivative segment. It is followed by BSE.

There are other exchanges like MCX and NCDEX for commodities & currencies trading which are not covered in this report.

The report is full of interesting statistics and is a nice read if you're interested.

I'll pick some of the figures I found interesting and explain my views on it.

91% individual traders lost money in FY24

This is definitely high and we will get into the different breakups below.

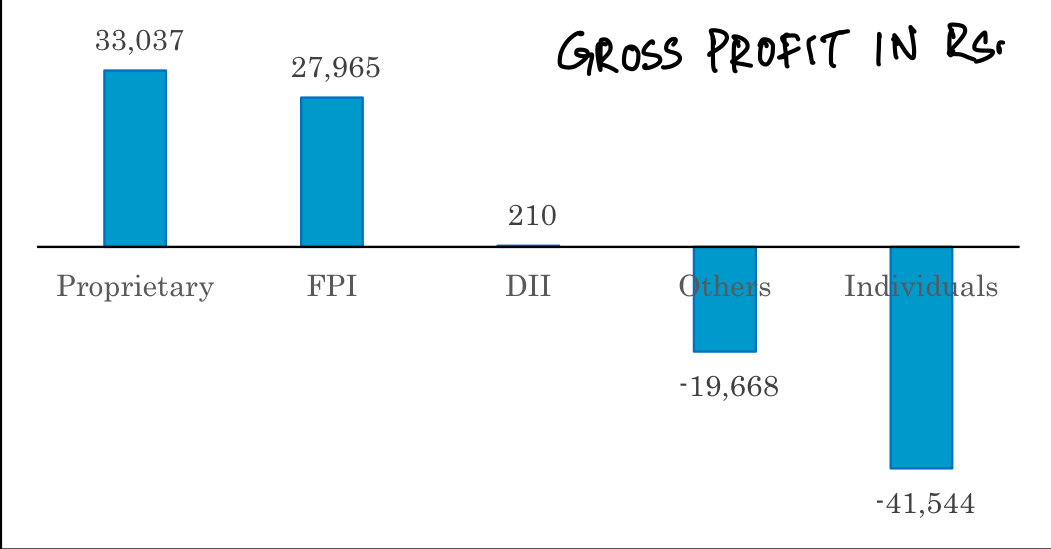

This is also a zero sum game (excluding transaction cost), and most of the profits accrue to more sophisticated players like Prop Traders, Foreign & Domestic Institutional Investors.

Surprisingly the "Others" category includes Corporates, Trust and PMS - who also incurred losses.

91.9% "male" traders made losses, 86.3% "female" traders made losses

Females, as usual, prove that they have a cooler head & are better traders than men. Similarly, in other reports, females are also better investors.

A small data caveat here is that broking accounts are usually shared between spouses which might skew these stats in either direction.

Over 75% of individual traders had annual income below ₹5 lakh.

This segment of users generally execute single leg options (also called naked orders) due to lack of funds for a proper hedged option strategy. They also incur the highest losses, usually burning through their entire trading capital in a few bad trades.

81% FPIs, 51% Prop Traders but only 13% individual traders used systematic trading of some form

Even those 13% individual traders that are using systematic trading of some form are still incurring heavy losses. These 13% individuals contribute 33% to the total loss of individual traders.

Infact, for "Others" and Individuals it was disadvantageous to use systematic trading.

There are far too companies that have "algo" or "quant" in their name running aggressive marketing campaigns towards retail traders. They partner with brokers with half-baked products & leaky order execution logics that only compounds customers losses. They generally have poor UI / UX that allows for little order tracking or real-time control.

This stat tends to be a bit close as one of our products - Tradebox - operates in this space for enterprise & retail traders. I, unfortunately, hear a lot of horror stories from brokers & customers about the less than responsible behaviour of such "algo" players.

On contrast, Prop Traders and Institutional Investors are using systematic trading to great advantage. Companies here face stricter quality checks as these customers are knowledgeable & sophisticated.

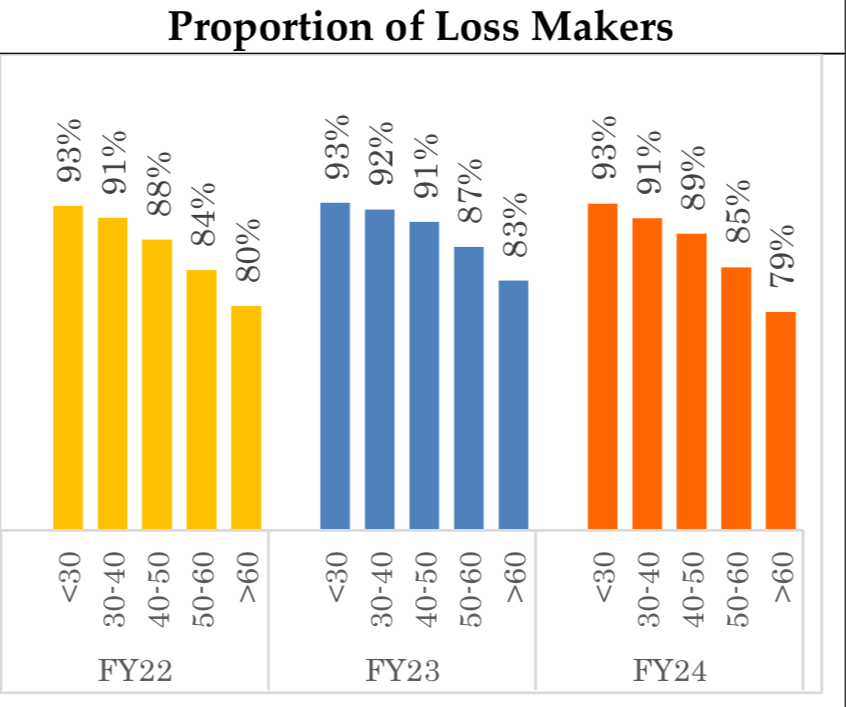

Trading skills improves with age

This is a strong indication that we grow wiser with age. 😊

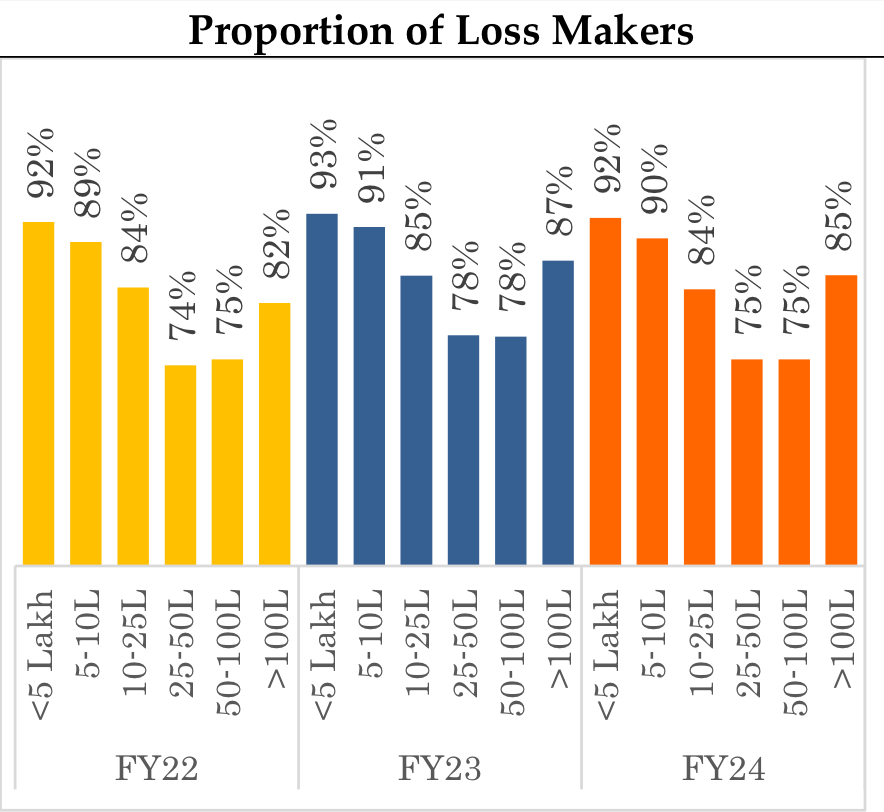

Trading skills decline as you get richer or poorer

This stat definitely is a bit philosophical and reveals a lot about our behaviour.

24.5 F&O traders for every 100 mutual fund investors

This figure was 20 in FY22 as compared to 24.5 in FY24. This indicates a faster growth than mutual fund segment.

It also means that there is a lot of room for further sensible & safe expansion into F&O segment for mutual fund customers.

A common use case for long term investors is to enter a "hedge" composed of multiple options that is designed to perform in downward moving markets. This hedge serves as portfolio insurance to offset losses of other equity investments.